Nanopowder-Based Additive Manufacturing in 2025: Unlocking Unprecedented Material Capabilities and Market Growth. Explore How Next-Gen Powders Are Shaping the Future of Advanced Manufacturing.

- Executive Summary: Key Trends and Market Drivers

- Nanopowder Material Innovations: Types, Properties, and Suppliers

- Additive Manufacturing Processes Leveraging Nanopowders

- Current Market Size and 2025–2030 Growth Forecasts

- Major Industry Players and Strategic Partnerships

- Application Spotlight: Aerospace, Medical, and Electronics

- Regulatory Landscape and Industry Standards

- Challenges: Scalability, Cost, and Quality Control

- Emerging Research, Patents, and Technology Roadmap

- Future Outlook: Disruptive Opportunities and Investment Hotspots

- Sources & References

Executive Summary: Key Trends and Market Drivers

Nanopowder-based additive manufacturing (AM) is rapidly emerging as a transformative force in advanced manufacturing, driven by the unique properties of nanoscale powders and the growing demand for high-performance, lightweight, and functionally graded components. As of 2025, the sector is witnessing accelerated adoption across aerospace, medical, electronics, and energy industries, underpinned by significant advancements in nanopowder production, process control, and end-use applications.

A key trend shaping the market is the increasing availability and quality of metal and ceramic nanopowders, with leading producers such as Höganäs AB and American Elements expanding their portfolios to include highly pure, monodisperse nanopowders tailored for AM processes. These materials enable the fabrication of parts with superior mechanical properties, enhanced surface finish, and novel functionalities, such as improved thermal or electrical conductivity. The push for miniaturization and complex geometries in sectors like microelectronics and biomedical devices is further accelerating demand for nanopowder-based AM.

Process innovation is another major driver. Equipment manufacturers such as EOS GmbH and 3D Systems are integrating advanced powder handling, in-situ monitoring, and closed-loop feedback systems to address the challenges of nanopowder flowability, agglomeration, and safety. These improvements are critical for ensuring repeatability and scalability, especially as end-users seek to transition from prototyping to full-scale production. The development of hybrid AM systems capable of processing both micro- and nanopowders is also expanding the design space and enabling new multi-material applications.

Sustainability and resource efficiency are increasingly important market drivers. Nanopowder-based AM offers significant material savings compared to traditional subtractive methods, aligning with the sustainability goals of major manufacturers and end-users. Companies such as GE are investing in closed-loop powder recycling and lifecycle management to further reduce waste and environmental impact.

Looking ahead to the next few years, the outlook for nanopowder-based additive manufacturing is robust. Ongoing collaborations between powder suppliers, AM equipment manufacturers, and end-users are expected to accelerate the qualification of new materials and the development of industry standards. As regulatory frameworks mature and the cost of nanopowder production continues to decrease, broader adoption across high-value sectors is anticipated, positioning nanopowder-based AM as a cornerstone of next-generation manufacturing.

Nanopowder Material Innovations: Types, Properties, and Suppliers

Nanopowder-based additive manufacturing (AM) is rapidly advancing in 2025, driven by innovations in nanoparticle synthesis, powder handling, and process integration. Nanopowders—metallic, ceramic, or composite particles with diameters typically below 100 nm—offer unique properties such as high surface area, enhanced sinterability, and tunable reactivity, making them highly attractive for next-generation AM applications. The current landscape is shaped by both established powder producers and emerging nanomaterial specialists, each contributing to the expanding ecosystem of printable nanomaterials.

Key material types include metallic nanopowders (e.g., titanium, aluminum, copper, and nickel alloys), ceramic nanopowders (such as alumina, zirconia, and silicon carbide), and composite or functionalized nanopowders (including core-shell structures and doped oxides). These materials are engineered for improved flowability, reduced agglomeration, and controlled oxidation, which are critical for consistent layer deposition and high-density part fabrication in AM processes like selective laser sintering (SLS), binder jetting, and direct energy deposition.

In 2025, several companies are at the forefront of nanopowder production for AM. Höganäs AB, a global leader in metal powders, has expanded its portfolio to include nanostructured iron, nickel, and copper powders tailored for AM, focusing on enhanced mechanical properties and printability. Tekna specializes in plasma atomization technology, producing high-purity titanium and aluminum nanopowders with controlled particle size distributions, which are increasingly adopted in aerospace and medical AM applications. American Elements supplies a broad range of metallic and ceramic nanopowders, emphasizing custom compositions and surface modifications to meet specific AM requirements.

Ceramic nanopowders are gaining traction for their potential in high-temperature and wear-resistant AM components. Tosoh Corporation is a prominent supplier of zirconia and alumina nanopowders, supporting the development of dense, complex ceramic parts via AM. Meanwhile, ECKA Granules (now part of GfE Metalle und Materialien GmbH) offers advanced metal and alloy nanopowders, with ongoing R&D into nano-enabled AM feedstocks.

Looking ahead, the outlook for nanopowder-based AM is promising. Ongoing research focuses on scalable, cost-effective nanopowder synthesis, improved powder handling systems, and the development of multi-material and functionally graded structures. Industry collaborations are accelerating the qualification of nanopowder-based AM parts for critical sectors such as aerospace, energy, and biomedical devices. As powder suppliers continue to refine particle engineering and surface chemistry, the next few years are expected to see broader adoption of nanopowder-enabled AM, unlocking new design freedoms and performance benchmarks.

Additive Manufacturing Processes Leveraging Nanopowders

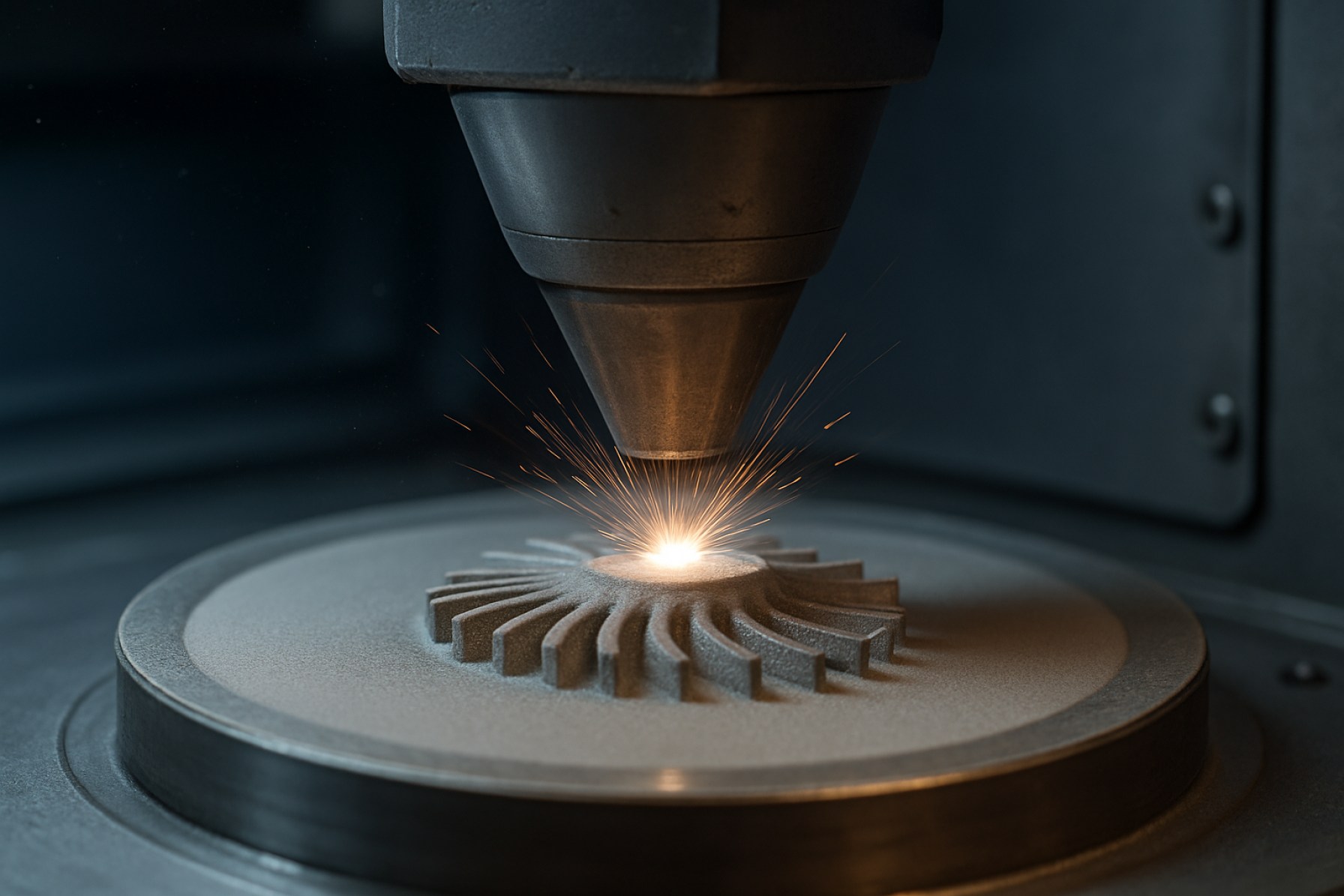

Additive manufacturing (AM) processes utilizing nanopowders are rapidly advancing in 2025, driven by the demand for components with superior mechanical, electrical, and functional properties. Nanopowders—particles with dimensions typically below 100 nanometers—offer unique advantages in AM, such as enhanced sintering kinetics, improved part density, and the ability to engineer novel material behaviors at the microstructural level. These benefits are being harnessed across several AM techniques, including powder bed fusion (PBF), binder jetting, and directed energy deposition (DED).

In powder bed fusion, the use of nanopowders enables the production of parts with finer microstructures and higher density compared to conventional micron-scale powders. Companies like EOS GmbH and 3D Systems are actively exploring the integration of nanopowders into their metal and polymer AM platforms, aiming to achieve improved surface finish and mechanical performance. The challenge of powder flowability, which is more pronounced with nanoparticles due to their high surface area and tendency to agglomerate, is being addressed through advanced powder engineering and surface modification techniques.

Binder jetting processes are also benefiting from nanopowder incorporation. The finer particle size allows for higher packing density and more uniform green parts, which, after sintering, result in components with reduced porosity and enhanced strength. ExOne, a leader in binder jetting technology, has reported ongoing research into nanopowder feedstocks for metals and ceramics, targeting applications in aerospace and medical devices where precision and material performance are critical.

Directed energy deposition, another key AM process, is leveraging nanopowder blends to fabricate functionally graded materials and complex alloys. The ability to tailor the composition at the nanoscale opens new possibilities for producing components with site-specific properties, such as wear-resistant surfaces or thermally conductive cores. GE Additive is among the organizations investing in DED systems capable of processing nanopowder-based feedstocks, with a focus on high-value sectors like energy and aviation.

Looking ahead, the outlook for nanopowder-based additive manufacturing is promising. Ongoing collaborations between powder manufacturers, AM system providers, and end-users are expected to yield new standards for nanopowder quality and handling. As process control and powder production technologies mature, the adoption of nanopowder-based AM is anticipated to expand, enabling the fabrication of next-generation components with unprecedented performance and functionality.

Current Market Size and 2025–2030 Growth Forecasts

The market for nanopowder-based additive manufacturing (AM) is experiencing robust growth as industries seek advanced materials for high-performance applications. In 2025, the global market size for nanopowder-enabled AM is estimated to be in the low single-digit billions (USD), with the aerospace, medical, and electronics sectors driving demand. This growth is underpinned by the unique properties of nanopowders—such as enhanced mechanical strength, improved sintering behavior, and superior surface finish—which are increasingly leveraged in powder bed fusion, binder jetting, and directed energy deposition processes.

Key players in the nanopowder production and AM ecosystem include GKN Powder Metallurgy, a major supplier of metal powders for additive manufacturing, and Höganäs AB, which has expanded its portfolio to include nanostructured powders for AM applications. EOS GmbH and 3D Systems are among the leading AM system manufacturers actively collaborating with powder suppliers to optimize process parameters for nanopowder use. Oxford Instruments and Tekna are notable for their advanced nanopowder production technologies, supporting the supply chain for high-purity, consistent feedstocks.

From 2025 to 2030, the nanopowder-based AM market is projected to grow at a compound annual growth rate (CAGR) exceeding 20%, outpacing the broader additive manufacturing sector. This acceleration is attributed to several factors:

- Increased adoption of nanostructured titanium, aluminum, and nickel alloys in aerospace and medical implants, where weight reduction and biocompatibility are critical.

- Ongoing R&D investments by companies such as GKN Powder Metallurgy and Höganäs AB to scale up nanopowder production and improve cost efficiency.

- Emergence of new AM platforms from EOS GmbH and 3D Systems designed specifically for fine and reactive powders, enabling more precise control over microstructure and part performance.

- Growing regulatory acceptance and standardization efforts, led by industry bodies and supported by powder suppliers, which are expected to accelerate qualification of nanopowder-based parts for critical applications.

Looking ahead, the market outlook remains highly positive. By 2030, nanopowder-based AM is expected to become a mainstream solution for high-value, performance-critical components, with supply chains maturing and costs declining as production scales. Strategic partnerships between powder manufacturers, AM system providers, and end-users will be pivotal in unlocking new applications and sustaining growth.

Major Industry Players and Strategic Partnerships

The landscape of nanopowder-based additive manufacturing (AM) in 2025 is characterized by the active involvement of major industry players and a surge in strategic partnerships aimed at advancing material capabilities, process reliability, and commercial scalability. As the demand for high-performance components in aerospace, medical, and electronics sectors intensifies, companies specializing in nanopowder production and AM systems are forging collaborations to accelerate innovation and market adoption.

A key player in this domain is GKN Powder Metallurgy, which has expanded its portfolio to include advanced metal nanopowders tailored for additive manufacturing. GKN’s ongoing investments in R&D and its partnerships with AM system manufacturers are focused on optimizing powder characteristics—such as flowability, purity, and particle size distribution—to enable finer feature resolution and improved mechanical properties in printed parts. In 2024, GKN announced a collaboration with several aerospace OEMs to co-develop next-generation titanium and aluminum nanopowders for lightweight, high-strength applications.

Another significant contributor is Höganäs AB, a global leader in metal powders, which has intensified its efforts in nanopowder research and production. Höganäs is working closely with additive manufacturing equipment providers to ensure compatibility and process stability, particularly for binder jetting and laser powder bed fusion technologies. The company’s strategic alliances with medical device manufacturers are aimed at leveraging the unique properties of nanopowders—such as enhanced surface area and sinterability—for custom implants and dental applications.

In the United States, Carpenter Technology Corporation has positioned itself at the forefront of the nanopowder AM market by expanding its portfolio of high-purity, spherical metal nanopowders. Carpenter’s recent investments in atomization technology and its partnerships with leading AM system integrators are designed to address the stringent quality requirements of the aerospace and defense sectors. The company’s focus on closed-loop supply chains and powder recycling is also setting new standards for sustainability in the industry.

On the technology front, 3D Systems and EOS GmbH are collaborating with nanopowder suppliers to refine process parameters and develop new machine architectures capable of handling ultra-fine powders. These partnerships are expected to yield commercial systems with enhanced resolution and throughput by 2026, further expanding the application envelope of nanopowder-based AM.

Looking ahead, the next few years are likely to see deeper integration between powder manufacturers, AM system developers, and end-users. The formation of consortia and joint ventures is anticipated, particularly in regions with strong government support for advanced manufacturing. As nanopowder-based AM matures, these strategic partnerships will be instrumental in overcoming technical barriers, standardizing material specifications, and accelerating the commercialization of high-value applications.

Application Spotlight: Aerospace, Medical, and Electronics

Nanopowder-based additive manufacturing (AM) is rapidly advancing in high-value sectors such as aerospace, medical, and electronics, driven by the unique properties of nanoscale powders—enhanced surface area, improved sintering behavior, and superior mechanical performance. As of 2025, the integration of nanopowders into AM processes is transitioning from research to early-stage industrial adoption, with several key players and collaborative initiatives shaping the landscape.

In aerospace, the demand for lightweight, high-strength components is accelerating the adoption of nanopowder-based AM. Companies like GE Aerospace are exploring the use of nanostructured titanium and nickel-based superalloy powders to produce turbine blades and structural parts with improved fatigue resistance and thermal stability. The fine particle size of nanopowders enables the fabrication of intricate geometries and thin-walled structures, which are critical for next-generation aircraft engines. Airbus is also investigating nanopowder AM for satellite and UAV components, aiming to reduce mass while maintaining or enhancing mechanical properties.

In the medical sector, nanopowder-based AM is enabling the production of patient-specific implants and devices with enhanced biocompatibility and osseointegration. Smith+Nephew and Stryker are among the medical device manufacturers evaluating titanium and hydroxyapatite nanopowders for 3D-printed orthopedic and dental implants. The nanoscale features promote better cell attachment and tissue integration, which is particularly valuable for complex bone scaffolds and porous implant surfaces. Regulatory pathways are being established for these advanced materials, with early clinical data supporting their safety and efficacy.

In electronics, nanopowder-based AM is opening new possibilities for miniaturized and high-performance components. DuPont and BASF are developing conductive nanopowder inks and pastes for printed circuit boards, sensors, and flexible electronics. The high surface area and reactivity of metal nanopowders, such as silver and copper, enable lower-temperature sintering and finer feature resolution, which are essential for next-generation microelectronics and Internet of Things (IoT) devices.

Looking ahead, the outlook for nanopowder-based AM in these sectors is promising, with ongoing investments in powder production, process optimization, and quality assurance. Industry collaborations, such as those led by Sandvik and Oxford Instruments, are focused on scaling up nanopowder synthesis and ensuring consistent material properties. As standards and supply chains mature, broader adoption is expected, particularly as cost barriers decrease and regulatory frameworks adapt to the unique challenges and opportunities of nanoscale materials in additive manufacturing.

Regulatory Landscape and Industry Standards

The regulatory landscape for nanopowder-based additive manufacturing (AM) is evolving rapidly as the technology matures and its industrial adoption accelerates. In 2025, regulatory bodies and industry organizations are intensifying efforts to address the unique challenges posed by the use of nanopowders—such as health, safety, and environmental risks—while also fostering innovation and standardization.

A key focus is the development and harmonization of standards for nanopowder characterization, handling, and integration into AM processes. The International Organization for Standardization (ISO) and the ASTM International have both established technical committees dedicated to additive manufacturing and nanotechnologies. In 2025, these organizations are updating and expanding standards such as ISO/ASTM 52900 (Additive manufacturing — General principles) and ISO/TS 80004 (Nanotechnologies — Vocabulary), with new guidance on nanopowder-specific parameters including particle size distribution, purity, and agglomeration behavior.

On the regulatory front, agencies like the Occupational Safety and Health Administration (OSHA) in the United States and the European Chemicals Agency (ECHA) in the European Union are reviewing and updating workplace exposure limits and safety protocols for nanomaterials. In 2025, ECHA is expected to further refine its REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework to include more explicit requirements for the registration and safe use of nanopowders in AM, particularly for metals such as titanium and aluminum alloys.

Industry consortia and leading manufacturers are also playing a pivotal role in shaping best practices. Companies such as EOS GmbH, a major supplier of AM systems and materials, and GE, which operates advanced AM production facilities, are collaborating with standards bodies to validate safe handling procedures and quality assurance protocols for nanopowder feedstocks. These efforts are complemented by initiatives from the Additive Manufacturing UK and the America Makes innovation institute, which are facilitating industry-wide dialogue and pilot programs to test and refine regulatory approaches.

Looking ahead, the next few years are expected to see the introduction of more comprehensive, globally harmonized standards and clearer regulatory pathways for nanopowder-based AM. This will likely include digital traceability requirements for powder batches, stricter environmental controls, and certification schemes for both materials and finished parts. As regulatory clarity improves, it is anticipated that adoption of nanopowder-based AM will accelerate across sectors such as aerospace, medical devices, and energy, with enhanced safety and quality assurance underpinning broader commercialization.

Challenges: Scalability, Cost, and Quality Control

Nanopowder-based additive manufacturing (AM) is poised to revolutionize high-performance components across aerospace, medical, and electronics sectors. However, as of 2025, the industry faces significant challenges in scaling up production, controlling costs, and ensuring consistent quality—factors that will shape its trajectory over the next several years.

Scalability remains a primary hurdle. The production of nanopowders with uniform particle size and morphology at industrial volumes is technically demanding. Leading powder manufacturers such as Höganäs AB and GKN Powder Metallurgy have invested in advanced atomization and chemical synthesis methods, but scaling these processes without compromising powder quality is complex. The risk of agglomeration and contamination increases with batch size, impacting downstream AM processes. Equipment manufacturers like EOS GmbH and 3D Systems are developing printers with improved powder handling and closed-loop feedback systems, yet integration with nanopowder feedstocks at scale is still in early stages.

Cost is another critical barrier. Nanopowders are significantly more expensive than their micron-sized counterparts, often by an order of magnitude, due to energy-intensive synthesis, stringent purity requirements, and specialized packaging to prevent oxidation or moisture uptake. For example, titanium and nickel-based nanopowders, widely used in aerospace, can cost several hundred dollars per kilogram. Companies like Tekna and AP&C (Advanced Powders & Coatings) are working to optimize plasma atomization and other scalable production methods, but price parity with conventional powders is unlikely in the near term. This cost premium limits adoption to high-value applications where performance gains justify the investment.

Quality control is a persistent challenge, especially as AM moves toward serial production. Nanopowders are highly reactive and prone to oxidation, which can degrade mechanical properties of printed parts. Ensuring batch-to-batch consistency in particle size distribution, surface chemistry, and flowability is essential. Industry leaders such as GE Additive and Renishaw are developing in-line monitoring and real-time analytics to detect anomalies during both powder production and printing. However, standardized protocols for nanopowder characterization and qualification are still evolving, with organizations like ASTM International working on new guidelines specific to nanoscale feedstocks.

Looking ahead, the next few years will likely see incremental progress as manufacturers refine production methods, automate quality assurance, and target niche markets where nanopowder-based AM delivers unique value. Broader adoption will depend on breakthroughs in scalable, cost-effective powder synthesis and robust, industry-wide quality standards.

Emerging Research, Patents, and Technology Roadmap

Nanopowder-based additive manufacturing (AM) is rapidly advancing, with 2025 marking a pivotal year for both research breakthroughs and the translation of laboratory-scale innovations into industrial applications. The integration of nanopowders—metallic, ceramic, and composite—into AM processes is enabling the fabrication of components with enhanced mechanical, electrical, and thermal properties, as well as finer feature resolution and improved surface finishes.

Recent research has focused on optimizing powder characteristics such as particle size distribution, morphology, and surface chemistry to improve flowability, packing density, and sintering behavior. For example, the use of nano-sized titanium and aluminum powders in laser powder bed fusion (LPBF) and binder jetting is being actively explored to produce lightweight, high-strength aerospace and biomedical components. Companies like GKN Powder Metallurgy and Höganäs AB are investing in the development and scale-up of nanopowder production tailored for AM, with a focus on consistency and safety in handling reactive nanomaterials.

Patent activity in this domain has intensified, with filings related to novel nanopowder synthesis methods (e.g., plasma atomization, chemical vapor synthesis), surface functionalization techniques, and AM process parameter optimization for nanoscale powders. Notably, 3D Systems and EOS GmbH have expanded their intellectual property portfolios to cover proprietary powder blends and process controls that address challenges such as nanoparticle agglomeration and powder bed uniformity.

Collaborative research initiatives are also shaping the technology roadmap. For instance, Sandvik is working with academic and industrial partners to develop next-generation nanostructured alloys for AM, targeting applications in energy, medical, and tooling sectors. Meanwhile, GE Additive is advancing process monitoring and closed-loop control systems to ensure repeatability and quality when using nanopowders in electron beam and laser-based AM platforms.

Looking ahead to the next few years, the outlook for nanopowder-based AM is promising. Key milestones anticipated include the commercialization of new nanostructured materials with tailored properties, the standardization of nanopowder specifications for AM, and the implementation of digital twins and AI-driven process optimization. Industry bodies such as ASTM International are expected to play a crucial role in developing standards for nanopowder characterization and safe handling in AM environments. As these advances converge, nanopowder-based AM is poised to unlock new design freedoms and performance benchmarks across high-value industries.

Future Outlook: Disruptive Opportunities and Investment Hotspots

Nanopowder-based additive manufacturing (AM) is poised for significant disruption and investment in 2025 and the coming years, driven by advances in nanoparticle synthesis, powder handling, and AM process integration. The unique properties of nanopowders—such as high surface area, enhanced reactivity, and tunable composition—are enabling the production of components with superior mechanical, electrical, and thermal characteristics compared to those made with conventional powders.

Key industry players are accelerating the commercialization of nanopowder-based AM. GKN Powder Metallurgy, a global leader in metal powders and AM, is actively developing nanopowder feedstocks for binder jetting and laser-based processes, targeting sectors like aerospace and automotive for lightweight, high-strength parts. Höganäs AB, another major powder producer, is investing in nanoparticle-enhanced alloys to improve printability and part performance, with a focus on energy and medical applications. EOS GmbH, a pioneer in industrial 3D printing, is collaborating with material suppliers to qualify nanopowder-based materials for its metal AM platforms, aiming to unlock new geometries and functionalities.

In 2025, disruptive opportunities are emerging in several domains:

- Advanced Aerospace Components: Nanopowder-based AM enables the fabrication of turbine blades, heat exchangers, and lightweight structural parts with enhanced fatigue resistance and thermal stability. Companies like GE are exploring these materials for next-generation jet engines and space systems.

- Medical Implants and Devices: The biocompatibility and tailored porosity achievable with nanopowders are attracting investment in patient-specific implants and drug delivery devices. Sandvik is expanding its AM powder portfolio to include nano-alloys for orthopedic and dental applications.

- Energy and Electronics: Nanopowder-based AM is being leveraged for high-performance battery components, fuel cells, and heat sinks. 3D Systems and Renishaw are both investing in R&D to address the challenges of powder flowability and sintering at the nanoscale.

Investment hotspots are expected in regions with strong AM ecosystems and advanced materials research, such as the US, Germany, Sweden, and Japan. Public-private partnerships and government funding are accelerating pilot projects and scale-up efforts, particularly in defense, healthcare, and energy sectors.

Looking ahead, the outlook for nanopowder-based AM is robust. As process control, safety, and cost barriers are addressed, the technology is expected to move from prototyping to full-scale production, opening new markets and applications. Strategic collaborations between powder manufacturers, AM machine builders, and end-users will be critical to realizing the disruptive potential of nanopowder-based additive manufacturing in the next few years.

Sources & References

- American Elements

- EOS GmbH

- 3D Systems

- GE

- Tekna

- ECKA Granules

- ExOne

- Oxford Instruments

- Carpenter Technology Corporation

- Airbus

- Smith+Nephew

- DuPont

- BASF

- Sandvik

- International Organization for Standardization

- ASTM International

- European Chemicals Agency

- AP&C (Advanced Powders & Coatings)

- Renishaw